DID YOU KNOW SOME SAVINGS ACCOUNTS PAY MORE THEN OTHERS?

- Clear Direction Financial

- Sep 20, 2019

- 3 min read

It's no secret most of banks don't pay much when it comes to your local savings account.

According to the FDIC as of 9/16/2019 the national rate is only 0.09. Thats pretty pathetic!

When the standard rate for savings accounts are so low why bother savings at all?

Two reason:

1. You're not saving into the correct account; so, you're leaving free money on the table.

2. These types of accounts are not created to create wealth. More on this in our blog called "SAVINGS ACCOUNTS DON'T PAY ANYTHING WHY HAVE ONE?"

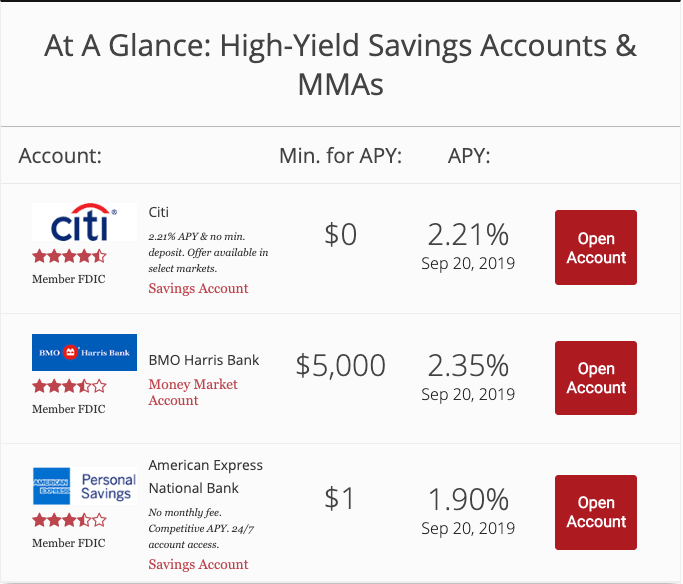

We've looked into some savings accounts that pay more then the standard savings offered at your bank.

"The Vanguard Prime Money Market Fund (VMMXX) is one of the money market mutual funds that saw its yield rise in 2018, with a distribution yield that rose from 1.12% in September 2017 to 2.11% during the same month in 2018. As of mid-April 2019, the fund has a compound yield of 2.48%".

If you're finding it shocking some accounts are paying so much more then your average bank, don't feel bad, the average shopper doesn't know this either.

Monthly Minimums and opening Balances

Some banks require you have a minimum in your account in order to avoid a monthly charge or a minimum to open the account. Bank of America, for example, requires that you have $300 in your account and Vanguard requires an opening balance of $1,000.

Overview of the Vanguard Prime Money Market Fund

When the Federal Reserve increases interest rates, investors start to eye money market mutual funds. The yields of money market mutual funds are largely dependent on the interest rate environment, meaning their yields will likely rise as interest rates rise.

Conclusion

As we said earlier the reason to be saving something in these accounts is to not leave money on the table. These accounts are not created to invest in, for more information on the purpose of these accounts and how to use them correctly check out our blog "SAVINGS ACCOUNTS DON'T PAY ANYTHING WHY HAVE ONE?"

Any of these account would be a better alternative than your standard bank savings account, you should look into them for basic savings.

In our view if you have the funds available to open the account the Vanguard money market account is the best option for returns, in addition to one stop funds management.

If you're just starting out the Citi would be good place to get to your $1,000 opening balance together with no min for its APY it really doesn't get any better.

So whether you have $10, or $10,000 cash, you can open up a Citi savings account and start earning today!

Sources:

Disclaimer:The rate information above is obtained by Bankrate from the listed institutions. Bankrate cannot guaranty the accuracy or availability of any rates shown above. Institutions may have different rates on their own websites than those posted on Bankrate.com.

All rates are subject to change without notice and may vary depending on location. These quotes are from banks, thrifts, and credit unions, some of whom have paid for a link to their own Web site where you can find additional information. Those with a paid link are our Advertisers. Those without a paid link are listings we obtain to improve the consumer shopping experience and are not Advertisers. To receive the Bankrate.com rate from an Advertiser, please identify yourself as a Bankrate customer. Bank and thrift deposits are insured by the Federal Deposit Insurance Corp. Credit union deposits are insured by the National Credit Union Administration.

Consumer Satisfaction: Bankrate attempts to verify the accuracy and availability of its Advertisers' terms through its quality assurance process and requires Advertisers to agree to our Terms and Conditions and to adhere to our Quality Control Program. If you believe that you have received an inaccurate quote or are otherwise not satisfied with the services provided to you by the institution you choose, please click here.

Rate collection and criteria: Click here for more information on rate collection and criteria.

Comments